Despite the Technological Revolution of Todays' Banking Institutions, Image is Still the Key Consumer Driver

In today's fast-paced world, where consumers have an array of options at their fingertips, the significance of corporate branding for banks and credit unions cannot be overstated. Beyond mere financial services, these institutions have become synonymous with trust, reliability, and financial stability.

Banks and Credit Unions, like many other consumer outlets, must move with the motion of consumer needs. Corporate branding plays a large role in ensuring a business can meet customer expectations.

Corporate branding goes beyond logos and slogans; it encompasses the overall perception and reputation of a financial institution. When effectively executed, corporate branding can differentiate banks and credit unions in a highly competitive market, foster customer loyalty, and attract new clients.

A strong corporate brand instills trust and confidence in consumers. Banks and credit unions with a solid reputation for reliability and integrity are more likely to attract and retain customers, even amidst market fluctuations and economic uncertainties.

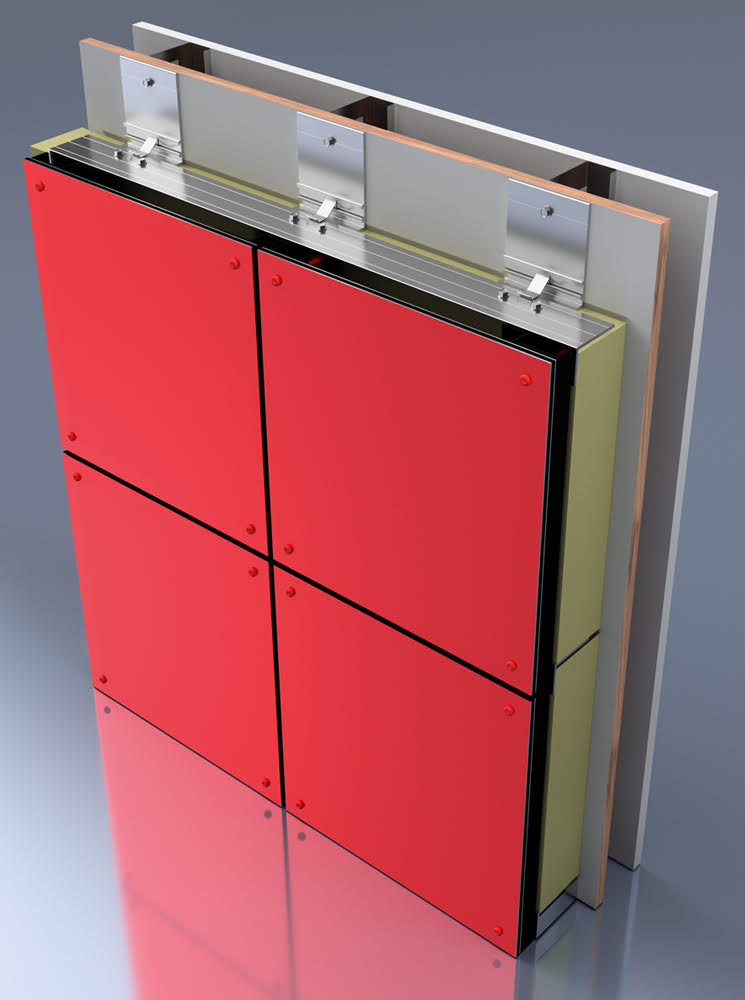

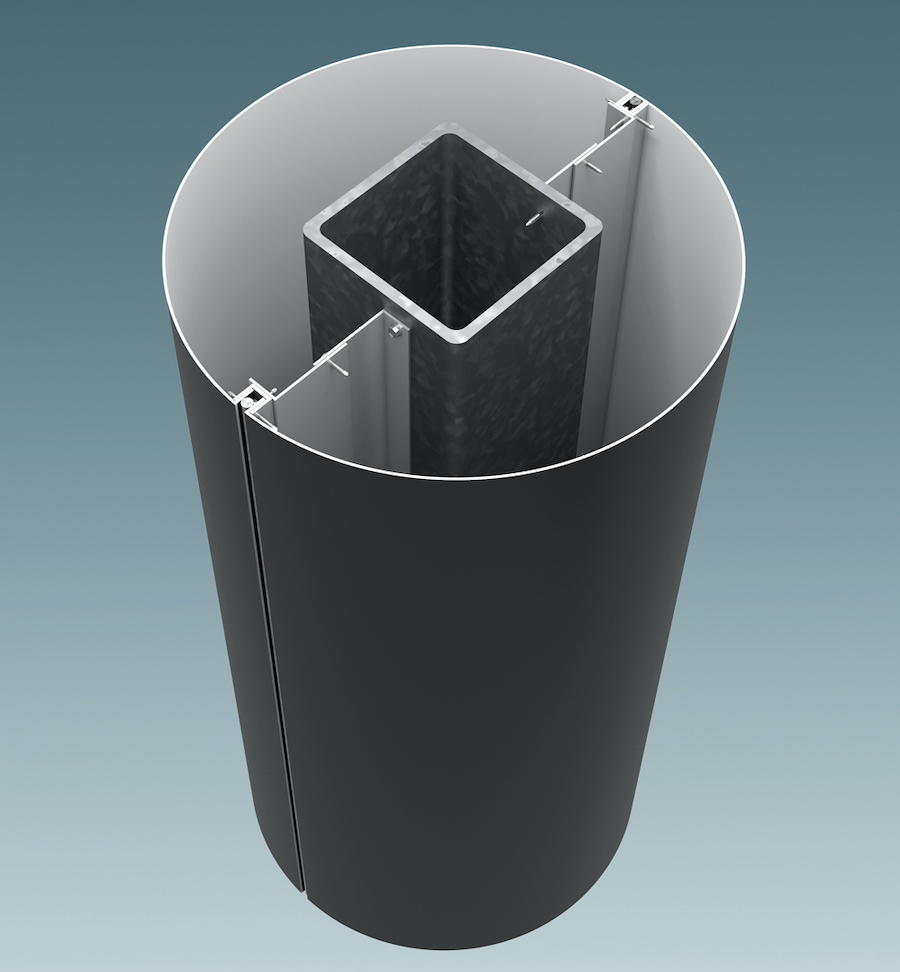

Corporate branding extends to the overall customer experience, from the physical design of branches to online platforms and customer service. Institutions that prioritize a seamless and user-friendly experience create a lasting impression on customers, leading to increased satisfaction and loyalty.

In an increasingly crowded marketplace, a distinct corporate identity sets banks and credit unions apart from their competitors. Consistent branding across all touchpoints reinforces the institution's values and unique selling propositions, making it more memorable and appealing to consumers.

To establish itself as an industry leader, corporate entities should be educated on growing trends within their own space. As the world has come into an era where people are more closely connected than before, corporate brands are now committed to developing current-day solutions to niche issues. Growing trends today that are valued in many industries include personalization, social responsibility, digital innovation, and authenticity.

With advancements in technology and data analytics, banks and credit unions can tailor their branding strategies to individual preferences and behaviors. Personalized marketing campaigns, product recommendations, and customized experiences will become more prevalent, enhancing customer engagement and satisfaction.

Many customers today want to support a company that is not only transparent and authentic but is also committed to social responsibilities to the world.

In an era of heightened scrutiny and distrust, authenticity and transparency are paramount for corporate branding. Banks and credit unions that communicate openly, address concerns promptly, and demonstrate genuine empathy will build stronger connections with customers and foster long-term loyalty.

As consumers become more environmentally and socially conscious, banks and credit unions are aligning their branding efforts with sustainability initiatives and corporate social responsibility. From eco-friendly branch designs to community outreach programs, institutions are demonstrating their commitment to making a positive impact beyond financial services.

The rise of digital banking has revolutionized the way customers interact with financial institutions. Future trends in corporate branding will focus on creating cohesive omnichannel experiences that seamlessly integrate online, mobile, and in-person interactions. Banks and credit unions will invest in intuitive digital platforms, augmented reality solutions, and virtual reality experiences to enhance brand engagement and accessibility.

Corporate branding plays a pivotal role in shaping the identity and reputation of banks and credit unions. As these institutions adapt to evolving consumer preferences and technological advancements, the importance of a strong and cohesive brand strategy cannot be overstated. By embracing emerging trends and prioritizing trust, innovation, and customer-centricity, banks and credit unions can navigate the ever-changing world of finance and continue to thrive in the future.

.png)